A home finance loan is usually a loan secured by residence, usually housing house. Lenders outline it as The cash borrowed to pay for property. In essence, the lender allows the client shell out the seller of a household, and the customer agrees to repay the money borrowed over a timeframe, usually 15 or 30 decades in the U.S. Monthly, a payment is comprised of buyer to lender. A part of the regular payment is known as the principal, which can be the first amount borrowed.

This method is mainly for people who get their paycheck biweekly. It is easier for them to sort a practice of using a portion from each paycheck to create property finance loan payments. Shown in the calculated results are biweekly payments for comparison needs.

Greatest for: Borrowers with good credit score who need to have a larger loan quantity and lengthy repayment terms that span a calendar year or for a longer time.

Additionally, some lenders are supplying coronavirus hardship loans that might be simpler to qualify for if the pandemic has impacted your employment. These modest crisis loans may feature reduced and even 0% curiosity, according to the lender.

Among the surprising points I uncovered is how a small big difference in fees can have an impact on your overall quantity paid out. Test using the calculator to examine different interest premiums.

During the underwriting method, your lender will do a “challenging pull” of the credit score. This tends to decrease your score, especially if you've got a number of challenging inquiries within just just some months.

The yearly percentage charge (APR) is Everything you’ll pay to borrow funds. It contains not only your interest charge but any charges billed with the lender — which include origination costs.

If standard loans aren't a possibility, you could examine alternatives including payday loans or installment loans. These kind of loans are usually available to men and women with negative credit history, However they normally include considerably bigger interest charges and fees.

Many personalized loan lenders give funding amounts that commence at all over $five,000. Nevertheless, that isn't excellent for somebody who needs to borrow considerably less as it forces them to submit an application for more cash than they'll truly will need (which implies higher month to month payments and fascination prices).

A co-borrower can be useful in many different other instances, far too. Like, if a borrower doesn't have a protracted more than enough credit history heritage to get authorised for the loan.

Who's this for? Prosper permits co-borrowers to post a joint software: This tends to absolutely be a large draw for some borrowers when you concentrate on that this isn't available for all loans.

Keep in mind that the co-borrower on a personal loan software shares the legal responsibility for repaying the loan with the first borrower, which is why lenders may even see a borrower as fewer dangerous if they may have A further human being applying along with them.

Having said that, just Understand that, like with any line of credit rating, the upper your credit history rating the more probably you will be to acquire the lowest curiosity costs.

Also, you may think about getting a cosigner with very click here good credit that is willing to make an application for the loan in your behalf. Using a cosigner can increase your chances of approval and potentially safe more favorable phrases.

Patrick Renna Then & Now!

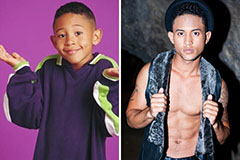

Patrick Renna Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Kane Then & Now!

Kane Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!